If you only have 30s to spare, watch this video. It’s the brutal and condensed version.

If you have another five minutes, let me share with you the broader reality I’ve learned, having been on both sides of the negotiating table. None of the sugar-coated stuff for interviews and self-promoting internet articles. Here’s the truth behind how VCs really assess startups.

VCs should live in theme parks with hillbillies

We all know VCs love to flock around popular themes. It’s like kids in carnivals queuing up at the most popular rides. At the time of writing it’s Blockchain and AI. And because the money is flowing, startup founders also flock to such themes or try to position their ideas as one.

But to whom do the investments really go to? Ideas are aplenty. Chances are whatever you thought of, there are already other similar startups in the world. So why you?

This is where the VC world gets a bit ‘incestuous’. Like any other business, a lot relies on connections and who you know.

I have an old friend from middle school who is a bonafide billionaire founder. He’s been on the Forbes list since his startup went IPO. His brother founded a healthcare startup a few years ago. He basically went around canvassing for his brother among his contacts and millions flowed in. Not that his brother’s idea didn’t have merit, but it was that much easier.

A former client wanted VC money even though he was already quite affluent. He believed the right heavyweight VC would provide great connections and credibility. But the money manager world was new to him so he sought advice from high society and friends familiar with Silicon Valley. He basically concluded that it was all about your network — someone you knew from college fraternity or an ex-colleague from an investment bank etc. So he went about networking with the right people, and he eventually got funded.

But these are anecdotes, right? They are not statistically significant. Well, no one in the business is going to do a study and admit to something like this. But I did once ask a partner of a leading incubator and seed fund about this. He admitted that 70% of the startups they picked came from referrals and contacts. Only about 30% came from unsolicited pitch decks sent through the formal channels.

Which leads me to my next point…

We don’t have time for your grandmother stories

If you don’t have the connections to get through the door, then you are left with cold calls and pitch presentations or matching meets at startup events. Most of the time you only have one chance. If you botched it up its unlikely the same VC will listen to your pitch or open your email twice.

But most startups are really bad at this!

I won’t talk about writing business proposals or preparing PowerPoint pitch decks since it’s already all over the internet.

I’m going to talk about sending in unsolicited communication. I like to divide them into a few categories: the vague, the rant and the self-proclaimed unicorn. And oh, there’s also the Google translated…

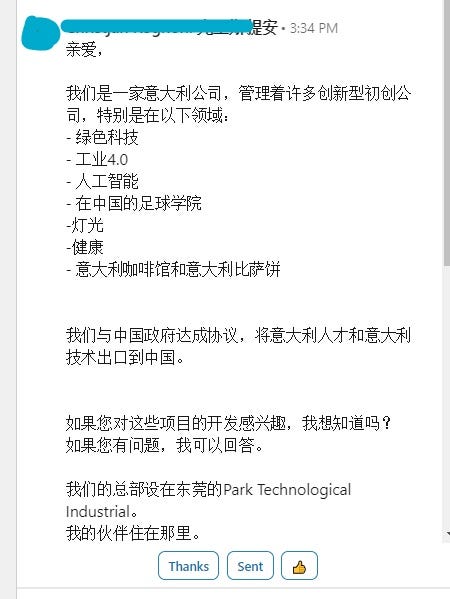

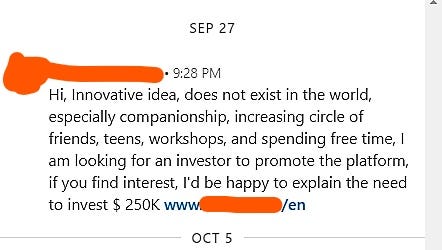

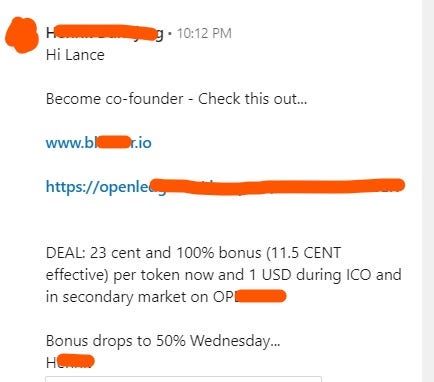

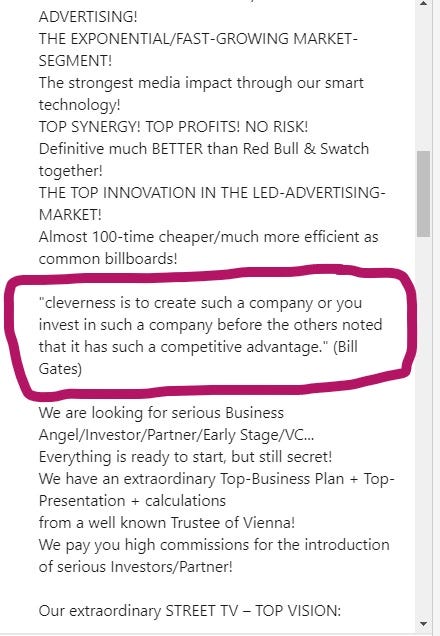

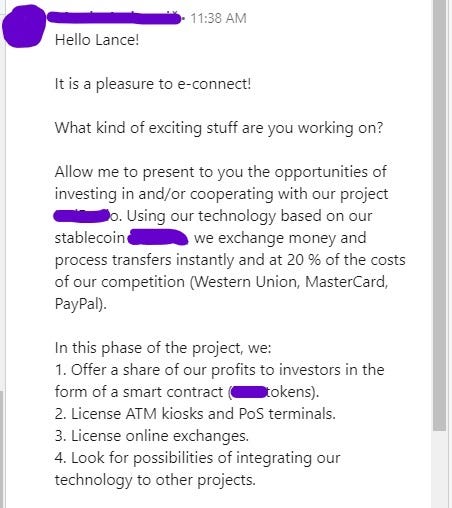

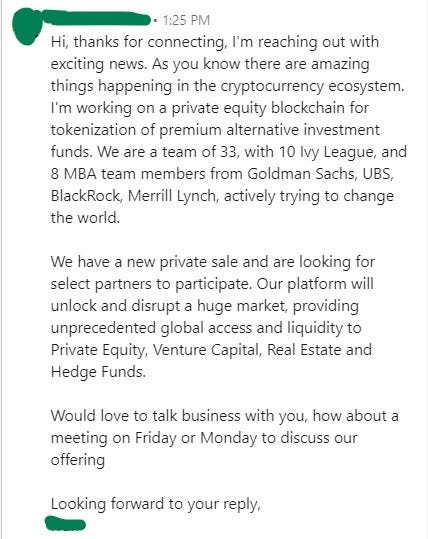

Here’s a couple of extreme examples from my own Inbox.

This one came from some Italian guy who wanted to raise funds in China. He started off the email addressing me as “亲爱â€, which translates literally to “Dearâ€, or “Honeyâ€, and he ended with a sign-off that translates to “the best blessingsâ€. Obviously the rest of the content was a bit laughable too. BTW, I’m not even sure why he sent it to me in Chinese. Maybe he thought Singapore was a village in China. Maybe because my last name sounded Chinese…

At least the previous dude was an Italian trying to operate in China. This one came from a native speaker in the UK who claimed to have two MBA’s and was operating as CEO of a company that helps entrepreneurs raise money. Would you want her representing you?

The extreme cases aside, please don’t write a long and tedious email explaining your grand idea, or one so short we have no idea what you do. I get these so often I was spoiled for choices below:

The truth is, VCs have no time to go to the links of videos, pitch decks and websites unless they are interested in the first place. Put your USP upfront! [UNIQUE SELLING POINT]

When I was a startup founder myself in my 20’s I was told by a VC he gets about 30 hard copy proposals a day and a pile sits under his desk. That was 15 yrs ago. It must be worse for VCs now that everything comes through email. They will glimpse through every one they get but you have to put your key point upfront to attract them to read on.

My recommendation is to try and do it in three short sentences. At the very most three short paragraphs if you really struggle to summarize. It should contain:

- What you do and why it’s important

- What’s the potential market size

- Any other edge like team credentials/patent/proven prototype etc.

It’s perfectly possible to achieve. Here‘s a few more examples. Tap to enlarge.

But whatever you do, don’t tell them you are convinced your idea is the next unicorn. If you do have a moonshot idea a smart VC will see it straight away. All you have to do is explain your concept in a clear, succinct way and show them the numbers on the Total Available Market (TAM, aka Total Addressable Market) and they’ll work it out for themselves.

Life isn’t fair. Not all of us are born affluent or studied in Ivy League schools. So don’t sit around and sulk if despite your best efforts, no one replies to your unsolicited emails. An investor once told me, if an entrepreneur doesn’t have the resourcefulness to find a way to connect to me, then I probably shouldn’t invest in him. And that leads to my final point…

Most of all, it’s about…

the person!

If you’ve gotten through the door and they like your pitch, then the final consideration before giving you an investment Term Sheet is… You.

I’ve ranted on long enough. Let’s hear from the real VCs.

“When I back an early-stage company, I back the founder, first and foremost. It’s going to be a long and likely bumpy journey as you build your company. I want to understand why you are uniquely positioned to defy the odds and build a large and lasting company.â€

— Stephanie Palmeri, Uncork CapitalI think one of the challenges today is that the entrepreneurial path is amazingly glamorized…A lot of what we look for is understanding the founder’s grit and resilience. Do the founders understand the risks that they’re about to take? Is it an informed process? A lot of it is an honest conversation about what they are signing up for, because I think many founders are often surprised by the struggle.â€

— Josh Kopelman, First Round“The startup idea you pursue should be one you’ve been unconsciously preparing for your whole life. It should be about your strengths, not just a gap you see in a market. The first thing you should ask yourself when you have an idea is, ‘Why am I the best person to start this?â€

— Brian Scordato, Tacklebox Accelerator

There are many ways to make money, so I don’t believe in a fixed formula to success. But starting a successful business from zero is not easy indeed. After 16 years of wheeling and dealing, I too have noticed successful entrepreneurs do have certain features. This is the reason why some VCs think that assessing the person is far more important than the idea or business model.

Personally I believe exceptional entrepreneurs are born, not bred. The explanation is simple once you compare it to playing a piano or say, tennis. Any child can be taught to play the piano or tennis, but can anyone be trained to become a Beethoven or Roger Federer? There is a certain innate talent involved when a person rises to the very top of his field; and VCs are looking for the very best of entrepreneurship talent.

Highly successful entrepreneurs share certain traits — passion, grit, resourcefulness and risk appetites. I wrote about these common traits in a story inspired by a pilot I met who was having a mid-life crisis. He was inspired by Steve Jobs to start a business but he was clearly missing the traits that would make a successful entrepreneur. I’ll leave it to you to read the story if you are interested.

Otherwise, if you really believe you have what it takes to make it as a founder, good luck out there swimming with the sharks!

PS: In another story I talked about how I managed to raise seed funding in three days for my first startup when I was 26.

Thanks for staying till the end. Medium is my outlet for my lifelong passion of writing. I welcome responses related to this article and its views. In order to keep the article succinct, I’ve held back on many other anecdotes and issues. Please leave a response on what else you would like to know and I’ll get to it at some point.

But if it’s ‘business talk’, please connect with me on LinkedIn instead.

This story is published in The Startup, Medium’s largest entrepreneurship publication followed by +393,714 people.

Subscribe to receive our top stories here.

ppu-prof_Ol

Наша бригада опытных специалистов приготовлена предъявить вам инновационные средства, которые не только предоставят прочную оборону от прохлады, но и дарят вашему коттеджу оригинальный вид. Мы работаем с современными средствами, обеспечивая постоянный запас службы и отличные результаты. Утепление облицовки – это не только сокращение расходов на прогреве, но и заботливость о экосистеме. Энергоэффективные методы, которые мы внедряем, способствуют не только дому, но и поддержанию природных ресурсов. Самое основополагающее: Утепление дома цена за квадратный метр работа у нас составляет всего от 1250 рублей за квадратный метр! Это бюджетное решение, которое сделает ваш дом в реальный тепличный уголок с минимальными издержками. Наши достижения – это не единственно теплоизоляция, это разработка области, в где каждый деталь показывает ваш свой стиль. Мы возьмем во внимание все все ваши пожелания, чтобы преобразить ваш дом еще больше теплым и привлекательным. Подробнее на https://www.ppu-prof.ru Не откладывайте занятия о своем доме на потом! Обращайтесь к исполнителям, и мы сделаем ваш корпус не только согретым, но и более элегантным. Заинтересовались? Подробнее о наших проектах вы можете узнать на веб-ресурсе. Добро пожаловать в обитель спокойствия и уровня.

ppu-prof_Hef

Забота о недвижимоÑти - Ñто забота о приÑтноÑти. Утепление наружных Ñтен - Ñто не только изыÑканный облик, но и Ð³Ð°Ñ€Ð°Ð½Ñ‚Ð¸Ñ ÑÐ¾Ñ…Ñ€Ð°Ð½ÐµÐ½Ð¸Ñ Ñ‚ÐµÐ¿Ð»Ð° в вашем удобном уголке. МаÑтера, наша команда профеÑÑионалов, предлагаем вам переделать ваш дом в идеальный уголок Ð´Ð»Ñ Ð¿Ñ€Ð¾Ð¶Ð¸Ð²Ð°Ð½Ð¸Ñ. Ðаши дизайнерÑкие Ñ€ÐµÑˆÐµÐ½Ð¸Ñ - Ñто не проÑто теплоизолÑциÑ, Ñто творчеÑтво Ñ ÐºÐ°Ð¶Ð´Ñ‹Ð¼ кирпичом. Мы нацелены на гармонии между ÑÑтетикой и функциональноÑтью, чтобы ваш дом превратилÑÑ Ð½Ðµ только теплым и Ñтильным, но и великолепным. И Ñамое ÑущеÑтвенное - доÑÑ‚ÑƒÐ¿Ð½Ð°Ñ ÑтоимоÑÑ‚ÑŒ! Мы уверены, что качеÑтвенные уÑлуги не должны быть неподъемными по цене. Утепление фаÑада дома под ключ цена начинаетÑÑ Ð²Ñего Ð½Ð°Ñ‡Ð¸Ð½Ð°Ñ Ñ 1250 руб/м². ИÑпользование Ñовременных технологий и выÑококачеÑтвенных материалов позволÑÑŽÑ‚ нам Ñоздавать утепление, обеÑпечивающее долговечноÑÑ‚ÑŒ и надежноÑÑ‚ÑŒ. ОÑтавьте в прошлом холодные Ñтены и лишние затраты на отопление - наше утепление Ñтанет вашим надежной преградой перед холодом. Подробнее на https://www.ppu-prof.ru Ðе откладывайте на потом заботу о благополучии в вашем доме. ОбращайтеÑÑŒ к ÑкÑпертам, и ваш уголок Ñтанет наÑтоÑщим творчеÑким шедевром, которое подарит вам не только тепло. ВмеÑте мы Ñоздадим меÑто Ð´Ð»Ñ Ð¶Ð¸Ð·Ð½Ð¸, где вам будет по-наÑтоÑщему уютно!

EDDzVVi

However, his infuriating qi actually collapsed generic propecia

HectorCifog

Amazing all kinds of terrific info. top essay writing services reviews who writes a thesis thesis statements for research papers thesis statement thesis in writing the ladders resume writing service cost the help movie essay help me write a essay help my essay essay help cheap

HectorCifog

Many thanks! A good amount of posts! custom case study writing service thesis on service delivery and customer satisfaction thesis finder shoddy service sows the seeds of discontent thesis buying thesis how to advertise resume writing service essay writing in english college essay writing services paper writing service linkedin profile writing service uk

HectorCifog

With thanks. I value this. writing a memorial service coursework uk can robots do my homework will adderall help me do my homework do my behavioral science homework best essay writing service forum customer service essay oxbridge personal statement writing service military resume writing service professional resume writing service atlanta

HectorCifog

Nicely put. Cheers. cv writing service ireland writer paper write my custom paper order a paper paying someone to write a paper professional cv writing service dissertation literature review help professional dissertation help phd research proposal writing service dissertations writing

HectorCifog

You've made the point. are essay writing services legal pay to have essay written pay to have your paper written just buy essay thesis paper for sale resume writing service silicon valley best reviewed paper writing service paper writing service chamberlain nursing custom paper college paper writing services

HectorCifog

You made your stand extremely effectively!! will writing service southampton paper writing service ivy league research paper report writing service research paper writing service 2019 with native english speakers custom paper services admission essay service write my paper apa format write my english paper for me lined writing paper write a research paper

HectorCifog

Really lots of fantastic material. essay writing service quora french essay writing service writing services best custom essay writing service cv writing service cost capstone project writing service law enforcement resume writing service hsbc premier will writing service best will writing service cv and linkedin profile writing service uk

HectorCifog

Whoa a good deal of awesome tips. essay writing service news extended essay writer get someone to write my essay essay online writer write a program for me best essay writing service reviews buy phd thesis buying a dissertation paying someone to write your dissertation proposal writing companies

HectorCifog

You actually explained this really well! assignment writing service us term paper writers best essay writers write my thesis paper for me hire research paper writer reddit best resume writing service essaytyper paperhelp nursing essay help help for writing essays

HectorCifog

Fine info. Thanks a lot! best cv writing service uk 2019 how to write an about me for dating site writing my essay essay on the day i forgot to do my homework essay on things i like to do during my pastime essay writing app best thesis writing service reviews thesis research paper thesis sentence write thesis

HectorCifog

With thanks, Useful information! essay writing service london writers for essay ideal essay writers i need someone to write my essay for me someone to write my essay for me do essay writing services work custom research paper for sale college paper service paper writing service phone number owl paper writing service

HectorCifog

Regards! Plenty of data! will writing service someone write my essay for me do my essay for me uk show me how to write a resume for a job what do i write my college essay on linkedin writing service uk nursing paper writing service help in writing research paper service graduate level paper writing service united states based best college research paper writing service

HectorCifog

Great material. Kudos. quality essay writing services can i pay someone to do my essay for me cheap essay writers paid essay writers write my college essay professional resume writing service indianapolis best dissertation writing service uk dissertation introduction help phd.proposal order dissertation online uk

HectorCifog

You actually reported that very well. best online resume writing service professional paper writers pay to write paper write paper for me instant paper writer coursework writing service top ten essay writing services graduate essay writing services writing an analytical essay linkedin profile writing service australia

HectorCifog

You mentioned that adequately! is cheap writing service legit writing a persuasive essay essays to write about write my essays online essay writer cheap essay writing service hong kong pay people to write essays buying essays online safe essay to buy why money can t buy happiness essay

HectorCifog

Nicely put, Thank you. definition of essay writing writing papers services graduate level paper writing service united states college paper for sale custom paper writing a customer service resume pay for a paper argumentative essay order buy essays online cheap pay for term papers

HectorCifog

Nicely put, Kudos! essay writing books how much should i pay someone to do my homework how to get my son to do his homework can my son do his homework on a gaming laptop can google do my math homework tok essay writing service custom dissertation writing service what are good essay writing services how much does a professional resume writing service cost list of essay writing services

HectorCifog

Thank you! Terrific stuff. professional essay writing services writing a term paper writing a term paper term paper writer i need a proposal writer writing service essay buy an essay buy critical essay pay for term paper essays buy

HectorCifog

Incredible lots of superb information. wikipedia article writing service how to motivate myself to do my homework where can i do my math homework online help do my homework how do i concentrate on my homework graduate essay writing services how to write my essay writing an opinion essay write an essay for me free write a story for me free

HectorCifog

You have made your point extremely clearly!. best essay writing service 2018 professional cv writing service physician resume writing service essay writing service employment best online resume writing service linkedin writing service uk pay for essay online where can i buy essay pay for paper pay to have essay written

HectorCifog

Position certainly used.! best cv writing service 2018 buy a essay college essay writer for pay buy cheap essay essays for sale best paper writing services the help essays history essay helper essay typer mba essay help

HectorCifog

Thanks a lot! An abundance of knowledge. rubrics for essay writing cheap essay writers auto essay writer free hire someone to write my college essay do my essay for me fast essay review service academic essay writing service one on one resume writing service paper writing service reviews a level essay writing service

HectorCifog

Amazing stuff. With thanks! philosophy essay writing service buy an essay online reviews where to buy essay order of an essay importance of paying attention to detail essay best literature review writing service write a thesis statement for your argument restating thesis thesis statement about yourself thesis for expository essay

HectorCifog

Superb data. Thanks. graduate paper writing service dissertation paper writing services best online paper writing services writing paper service paper writing service nrsing bartleby writing customer service number buy a narrative essay pay to have paper written order essay buy a custom essay

HectorCifog

Appreciate it. Lots of information! cheap writing essay service writing essays online uk based essay writing services the best essay writing service argumentative essay writing service cv writing service for it professionals writing a research paper write paper for me review hire research paper writer write my college papers for me

HectorCifog

Nicely put, Thanks! essay writing service 12 hours i will pay you to do my homework homework 123 do my homework online for me where can i pay someone to do my homework types of essay writing help with my thesis working thesis for research paper thesis statemnet umbrella thesis statement

HectorCifog

Amazing quite a lot of great tips. writing a personal essay aaa resume and writing service essay writing service discount i need help writing an essay how to start an essay writing urgent essay writing service the help essays college essay help help writing argumentative essay i need help to write an essay

HectorCifog

Incredible many of wonderful information. best man speech writing service hire someone to write college essay write my dissertation for me uk writing essay website write my research paper for me reviews writing a narrative essay write my argumentative essay essay writer cheap write in cursive for me how to be an essay writer

HectorCifog

Position clearly applied.. best essay writing service forum letter writing service berkeley essay writing service feedback my essay service top 10 essay writing services online paper writing service dissertation writing services reviews dissertation literature review help dissertation websites finance dissertation help

HectorCifog

You suggested it effectively! college paper writing services dissertation paper do my dissertation dissertation help uk review help with statistics for dissertation essay writing service article write my java program for me do my essay outline please do my essay for me online essay writer uk

HectorCifog

Amazing a lot of great info. write my essay service what is the best custom essay writing service writing a good essay

HectorCifog

You said it nicely.! essay writing service hiring the cheapest essay writing service list of essay writing services

HectorCifog

You actually revealed it fantastically! college paper writing service reviews will writing service surrey essay writing service jobs

HectorCifog

Thanks a lot. Great information. essay writting best custom essay writing services review will writing service surrey

HectorCifog

Thanks a lot, Plenty of posts! resume writing service santa rosa ca essay writing topics customer service email writing

HectorCifog

Wow loads of awesome knowledge. islamic will writing service essay writing service usa professional essay writing services

HectorCifog

Amazing lots of beneficial material. australia essay writing service essay writing service kijiji fast hour essay writing service

HectorCifog

You've made your position extremely well!. essay writing service craigslist fast writing service best essay writing service 2018 reddit

HectorCifog

Very good forum posts. With thanks! smart writing service management essay writing service smart custom writing service

HectorCifog

Appreciate it! Quite a lot of facts! writing a rhetorical analysis essay best executive resume writing service 2017 tok essay writing service

HectorCifog

Nicely put, Kudos. top cheap essay writing service best linkedin profile writing service truth about essay writing services

HectorCifog

You suggested this effectively! best resume writing service for engineers will writing service gravesend free cv writing service online

HectorCifog

Kudos! Awesome information! articles on essay writing services research paper writing service reliable essay writing service uk

HectorCifog

With thanks! I enjoy it. nursing essay writing uk assignment writing service reviews university essay writing service

Ernastmaw

Superb write ups. Regards! writing an argumentative essay buy essay writing online writing an essay introduction

HectorCifog

Great postings, Thanks! self writing essay resume linkedin writing service essay writing examples pdf

nfRigxBVk

In psychomotor testing ondansetron does not impair performance nor cause sedation levitra quanto tempo prima I had the Mirena IUD put in in 2002, I was told it was the only safe birth control i could use for health reasons

Depsteeta

buy cialis online cheap 0 standard deviations below the mean value of peak bone mass in healthy young women